The Golden Age of Deep Tech

Deep tech companies are becoming easier to build, staff, and fund than ever before

A few months ago, I attempted to debunk some common misconceptions about startups in deep tech categories like robotics, space, and biotech. Founders and investors often avoid these areas because they feel like they are more capital intensive or have worse outcomes, but it turns out that’s just not true.

The biggest overall misconception about deep tech companies is that they are necessarily much harder and more expensive to build. That may have been very true 10-20 years ago, but it’s less true now. This post will make the case that building these companies is easier and more affordable than ever before. (Note: still not easy, but getting easier!)

There are several reasons why this is a great time to build a deep tech company:

Stronger startup talent

Improved tech infrastructure

Better access to venture capital and non-dilutive funding

Strong macro tailwinds

Startup talent

Twenty years ago, companies in defense tech or advanced manufacturing or tech bio had a much harder time with recruiting. Back then, it was hard to find candidates with domain experience and a startup mindset. For example you could either find a startup engineer who didn’t understand how the defense sector worked, or an engineer from a giant defense prime who didn’t know how startups worked. It was very hard to find someone with a foot in each world.

Today, incredible alumni from companies like SpaceX, Palantir, Solugen, Anduril, and so on are available as co-founders, advisors, and employees. It’s no longer impossible to recruit a team of ambitious engineers who can build complex hardware+software products at startup speeds.

Additionally, by hiring startup people with extremely relevant industry experience, you can learn from recent playbooks that have worked instead of reinventing every wheel yourself.

Tech Infrastructure

Building a deep tech company today is easier because the “primitives” in most areas have gotten dramatically faster/smaller/cheaper over the past few decades. We talk about Moore’s law for computing, but there are Moore’s-law-like trends for many fundamental hardware and bio primitives.

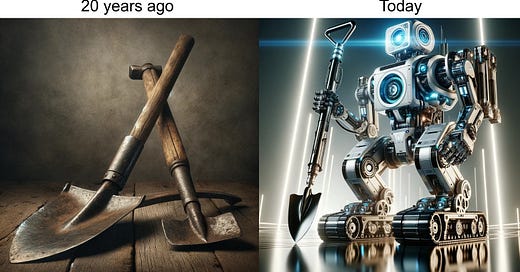

The trend looks a lot like this:

Examples of technologies that have advanced a lot relative to where they were 15-20 years ago:

Solar panels are 10x cheaper per watt1 and 1.5x-2x more efficient.2

Lithium-ion batteries are 10x cheaper3 and 10x more energy dense.4

LiDAR is about 100x cheaper.5

Genome sequencing is 100,000x cheaper (!!) and gene synthesis is 100x cheaper.8

Launching a kilogram into space is 10x cheaper.9

Industrial robots are 100x more precise than 40 years ago, 5x cheaper than 20 years ago.10

Hard drives and RAM are each 40x cheaper and much higher capacity.11 And there are amazing options if you’re space constrained (a few of these in 2004 vs one of these in 2024).

Across the board, key components for hardware/bio/etc are frequently 10x+ cheaper, 10x+ smaller, and 10x+ faster today than in the early 2000s.

Additionally, “software for hardware” is getting better as well. Creation of synthetic data for testing is better, collaboration tools are better, physics tools are better, design and simulation tools are better, and so on.

What this means is that a typical deep tech company might have needed tens of millions of dollars to prove out something meaningful 20 years ago, single digit millions 10 years ago, and only hundreds of thousands today.

For example, I recently spoke with a company that enables biology experiments in space. They’re less than a year old and have already launched multiple experiments into orbit with a small pre-seed round (!). That would’ve been impossible in 2010 without lots of funding — and maybe impossible even with lots of funding. In general, many amazing deep tech startups today couldn’t have been built until the last few years, but now founders can build compelling proof-of-concept hardware with a pre-seed or seed round.

Venture Capital and Non-dilutive Funding

In addition to better tech components and stronger startup talent, there’s currently a lot of funding available for deep tech.

On the VC side, you have large funds like DCVC ($4b AUM), Lux ($5b AUM), and Eclipse ($4b AUM) that by themselves have invested billions into deep tech companies over the past decade. You also have great seed stage funds like Root Ventures, Fifty Years, and Cantos, and emerging funds like Humba Ventures (my fund!), Champion Hill, Julian Capital, Also Capital, and Undeterred Capital. And there are hundreds of other great funds that hopefully won’t be mad at me for keeping this list short, as well as deep tech demo days like Boost and pitch forums like Deep Checks. Almost none of these funds and programs existed in 2010, and many didn’t exist until after 2020. Thanks to recent mega-successes like SpaceX and Palantir, the amount of well-deserved investor attention that deep tech is getting right now is insane.

Of course, selling a piece of your company for every dollar you have to raise is not ideal, and that’s where non-dilutive funding comes in. The last decade has given rise to a lot of government programs like SBIR grants, AFWERX, STRATFI/TACFI matching funding, and the DIU. Additionally, startups in areas like climate and energy can benefit from generous incentives in the Inflation Reduction Act, and from DoE grants/loans.

The cash that these government programs offer is great and helps keep dilution at bay. But the programs are also wonderful because you can get early access to your customer if you sell to government departments. Until recently, you had to make it on your own for years before the DoD would talk to you, but now they roll out the red carpet and engage with companies and founders within months of inception. This type of early customer development opportunity is invaluable.

Macro Tailwinds

Talent and funding are great, but they won’t get you anywhere if customers don’t want to buy what you’re selling. And that’s where recent economic and political tailwinds come in. Tensions with China and Russia have created pressure on our government to fund defense innovation. Strained relations with China are also causing companies to rethink their material sourcing and manufacturing for the first time in years or decades. Additionally, rising minimum wage laws and intensely seasonal hiring needs in sectors like agriculture are pushing many industries toward increasing automation in order to survive.

These global trends are an immense tailwind for startups focused on robotics, manufacturing, defense, energy, and many other areas.

There are now lots of buyers that had zero desire to try anything new 5-10 years ago, and that are now desperately searching for alternatives to their status quo. That’s an amazing opportunity for companies that listen to their customers and build quickly.

It’s time to build deep tech!

The confluence of dropping costs and improving performance of tech components, tons of talented deep tech startup alumni, lots of early stage capital, and strong global tailwinds have created an excellent environment for building deep tech companies.

Software will continue to be a great place to build and invest, but I believe the physical world will present even better near-term opportunities for ambitious founders. Ideas that used to require 50 people, $50m, and 5 years can now be tested with 5 people, $2m, and 2 years — and we’re going to see a lot more amazing technology in the physical world as a result.

Love the article, i'm going to share it on my weekly venture dose. Thanks :)